In regards to preparing for the longer term, daily life insurance coverage remedies are often the first thing people today contemplate. They provide a sense of security and relief, knowing that your family members will likely be fiscally shielded just in case the unpredicted comes about. But life coverage might be a tricky thought to grasp, specially when you are bombarded with so many different guidelines and conditions. So, how Are you aware which everyday living insurance coverage Alternative is ideal for you?

Allow’s break it down. Existence insurance coverage comes in a lot of sorts, each created to meet diverse demands and monetary plans. Irrespective of whether you’re trying to find anything very simple and very affordable, or a far more in depth plan that builds dollars price after a while, there’s a everyday living insurance policy Answer tailor-made just for you. But just before we dive in to the particulars, it’s crucial to be familiar with the goal of everyday living insurance plan. It’s not simply a financial security net; it’s a method to make certain that All your family members can go on to prosper, even if you're no more about.

The Best Guide To Global Insurance Solutions

The initial step in Discovering life insurance policy alternatives is to comprehend the different types of protection offered. The 2 principal groups are time period lifetime insurance policies and long lasting lifetime insurance policies. Time period everyday living insurance policies offers protection for a selected period of time, commonly 10, twenty, or 30 many years. It’s usually far more reasonably priced than long term everyday living insurance coverage, making it a favorite option for younger family members or individuals on a finances. On the other hand, as soon as the expression expires, the protection ends, which means it’s not an alternative If you prefer lifelong safety.

The initial step in Discovering life insurance policy alternatives is to comprehend the different types of protection offered. The 2 principal groups are time period lifetime insurance policies and long lasting lifetime insurance policies. Time period everyday living insurance policies offers protection for a selected period of time, commonly 10, twenty, or 30 many years. It’s usually far more reasonably priced than long term everyday living insurance coverage, making it a favorite option for younger family members or individuals on a finances. On the other hand, as soon as the expression expires, the protection ends, which means it’s not an alternative If you prefer lifelong safety.Then again, everlasting everyday living insurance policies remedies last your total life span, so long as premiums are paid. In long lasting everyday living insurance policies, there are actually different versions, which include complete life, common lifetime, and variable daily life insurance plan. Every single of such has its distinctive features, such as dollars worth accumulation, adaptable rates, and expense choices. Whole existence insurance policies, by way of example, offers a fastened high quality and a certain Demise reward, providing both security and a discounts part that grows after some time.

Now, let's take a look at the significance of getting the ideal daily life insurance Resolution for your own situation. When choosing a plan, it’s important to take into account your economical targets, household structure, and upcoming desires. Would you like your beneficiaries to get a substantial payout, or would you like a coverage that will function a monetary asset Later on? The answer to these questions might help manual you toward the right coverage. It’s also crucial to assess your budget—some procedures are more affordable than Some others, and you simply’ll desire to ensure the quality fits comfortably in your financial strategy.

Probably the most worthwhile facets of everyday living insurance coverage alternatives is their power to provide economic protection in your family members. If some thing had been to occur to you, your policy would pay out a Loss of life benefit that will help go over funeral charges, outstanding debts, and residing fees. But life coverage may serve other reasons further than preserving your family’s financial foreseeable future. For instance, some existence insurance policy methods present dwelling Advantages, which allow you to entry your plan’s dollars worth though you're still alive in case of a terminal ailment or other emergencies.

One more factor to take into consideration when choosing a lifetime insurance coverage solution is your age and wellbeing. The young and much healthier you're when you purchase a policy, the decrease your premiums are likely to be. When you wait till you are more mature or experiencing health issues, your rates might be significantly increased, or you may be denied coverage altogether. This is often why it’s essential to plan in advance and discover your choices When you're in great well being.

Everyday living insurance coverage could also Engage in a significant part in estate scheduling. For those who have assets that you might want to pass on towards your beneficiaries, a lifetime insurance coverage plan can assist present the required liquidity to include estate taxes, guaranteeing that your family and friends aren’t burdened with a sizable tax bill Once you move absent. By strategically incorporating existence insurance plan into your estate system, you can create a much more effective and cost-successful solution to transfer wealth.

Permit’s also talk about the pliability of existence coverage options. In today’s globe, our requires are regularly transforming. That’s why some long term everyday living insurance guidelines, like universal lifetime, offer you flexibility with regards to rates and death Added benefits. With common daily life insurance policy, you are able to alter your coverage as Explore here your instances evolve, making it a superb option for people today whose money condition may perhaps fluctuate as time passes. This overall flexibility is very handy for people who want to be sure their coverage remains in step with their desires.

Have you been a person who likes to choose an active purpose in handling your investments? If that is so, variable existence insurance policies may be the appropriate option for you. With variable everyday living insurance policy, you are able to allocate a part of your rates into many different financial investment selections, which include shares, bonds, or mutual resources. This can provide the potential for increased hard cash value accumulation, but What's more, it includes far more possibility. So, in case you’re relaxed with the idea Visit the site of current market fluctuations and want to be additional associated with your policy’s expansion, variable daily life insurance may be a fantastic match.

Needless to say, no everyday living insurance policy Alternative is without its disadvantages. Expression existence insurance, when reasonably priced, doesn’t provide any income worth or investment opportunity. When the phrase finishes, you might have to buy a different coverage, normally at a higher rate. Long-lasting lifetime insurance solutions, On the flip side, could be dearer and may not be needed for everyone. It’s important to weigh the pluses and minuses of each selection before you make a decision.

When buying everyday living coverage, it’s also imperative that you think about the reputation and monetary balance in the insurance provider. You would like to make sure that the corporation you decide on is monetarily sturdy and has a background of spending statements instantly. In spite of everything, The complete place of everyday living coverage is to offer satisfaction, which means you’ll want to pick a supplier you are able to rely on to deliver on their own promises.

How Health Insurance Solutions can Save You Time, Stress, and Money.

When everyday living insurance policies is A necessary Component of Lots of individuals’s monetary scheduling, it’s not the only Answer. You can find other approaches to guard Your loved ones and Construct prosperity, which include purchasing retirement accounts, savings strategies, and other sorts of coverage. Lifetime insurance policy must be observed as just one bit of a broader financial technique that can help you accomplish your extended-term goals and guard your loved ones.But let’s not forget about the psychological advantages of daily life insurance. Recognizing that Your loved ones will probably be looked after monetarily can deliver relief, particularly when you’re the primary breadwinner. Daily life insurance presents a security net, guaranteeing that your family members don’t have to battle fiscally immediately after your passing. It’s a present that retains on giving, extensive after you’re gone.

Insurance Coverage for Dummies

It’s also worthy of noting that lifestyle insurance policy answers generally is a worthwhile Software for business people. Should you very own a company and wish to make certain its continuity just after your death, lifetime insurance plan can offer the mandatory cash to order out your share on the company or to deal with any monetary obligations. Sometimes, life coverage can even be employed being a funding supply to get a purchase-promote agreement, assisting to shield your organization partners and protected the future of your company.

For those who’re Not sure about where to get started on In terms of selecting a lifestyle insurance coverage Option, think about working with a economic advisor or insurance plan agent. They can help you navigate different alternatives out there and ensure you’re producing an informed final decision determined by your exceptional problem. A specialist may also enable you to recognize the great print of each and every coverage, so you’re clear on what’s Learn it all included and what’s not.

In summary, lifestyle insurance plan methods are A vital element of the reliable economical approach. Irrespective of whether you choose term daily life or long term daily life coverage, the purpose is similar: to protect your family members and supply money protection after they require it most. By comprehending your choices and deciding on the suitable policy for your preferences, you'll be able to make certain that your family is properly looked after, it doesn't matter what the longer term holds. So, go to the trouble to investigate your options and find a lifestyle insurance plan Resolution that works for you. Your family members will thank you for it.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Katey Sagal Then & Now!

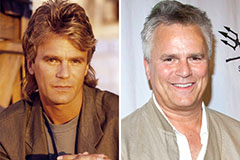

Katey Sagal Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!